Image may be NSFW.

Clik here to view. Whether you prefer active investing or passive investing, or aren’t investing at all, it’s pretty clear that the stock market is unpredictable. However, some people are convinced they have what it takes to beat it. They may look up company reports, scour for little-known information, and study trends and ratios for hours at a time. Many moves and trades later, these investors may believe that they have actually beaten the market, but this is usually because they haven’t actually experienced being invested during a bear market. It’s easy to think you’re a fabulous investor during a bull market when everything is going up.

Whether you prefer active investing or passive investing, or aren’t investing at all, it’s pretty clear that the stock market is unpredictable. However, some people are convinced they have what it takes to beat it. They may look up company reports, scour for little-known information, and study trends and ratios for hours at a time. Many moves and trades later, these investors may believe that they have actually beaten the market, but this is usually because they haven’t actually experienced being invested during a bear market. It’s easy to think you’re a fabulous investor during a bull market when everything is going up.

Sometimes savvy folks actually do beat the general market. For example, their returns may be far better than the earnings of the Dow or the S&P 500. But, are their brilliant trades repeatable? Is excellent performance even sustainable from one year to the next? Bull markets don’t last forever, and we could be facing declining growth in the months ahead.

Does Past Performance Matter?

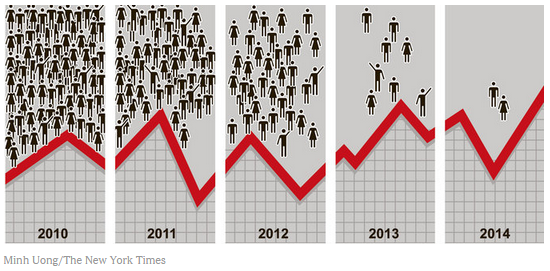

A study performed by the S&P Dow Jones Indices explored the question, “Does past performance matter?” When researching for the study, the analysts selected domestic stock funds that performed within the top 25% of other like-traded funds in 2010. Then, these analysts observed how many of these managed funds remained in the top 25% over the course of the next four years.

Out of the original 2,862 funds that were selected for the study, only 2 performed in the top 25% of the domestic stock funds in each of the five years. Even among highly skilled fund managers, past performance is not easily repeatable when it comes to the intricacies of the ever-changing stock market. Take a look at the below chart that the NY Times put together based on the study.

Image may be NSFW.

Clik here to view.

In the same light, questions often arise regarding actively managed funds vs. a benchmark index (the common reference of index returns is the S&P 500). On average, which funds provide the highest returns: the Index or an actively managed stock fund?

The basic premise is that actively managed funds would provide a higher return because there is an incredibly intelligent fund manager at the helm of each transaction. When the market takes an unexpected turn, the fund manager can make an immediate change, thereby saving investors from losses that they would have otherwise experienced had they been investing on their own.

Theoretically, professional fund managers should also be able to spot trends in the market and trade for higher gains than the Average Joe, who isn’t able to devote the same amount of time to such research.

Comparing Passive Versus Active Investment Returns

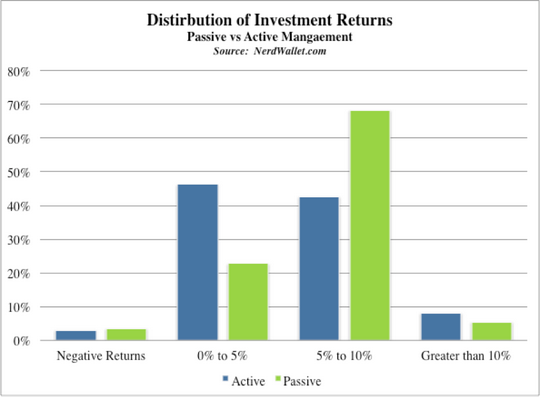

Research has shown that average actively managed funds have outperformed passive indices, but only by 0.12%. And note that figure is prior to factoring in the different fees associated with the active trades made by the fund managers.

Image may be NSFW.

Clik here to view.

Since fees and investment costs can really impact your portfolio’s returns over time, it’s important to incorporate those expenses into our analysis of active versus passive investing. As seen in the graph above, approximately 46% of active funds earned a return between 0% and 5% after all of the fees were considered. Another 41% of active funds earned a return between 5% and 10%. That might sound good by itself, but passive index funds clearly blow active investing out of the water in the 5-10% range.

If the general stock market earns 8% over the course of a year, then the average actively traded mutual fund would earn 8.12% (slightly above the average) based on the study referenced above prior to fees. However, since many mutual funds charge between 1% and 3% in fees, the average returns of these funds land below that of the general market, therefore creating the negative-sum game.

What Types Of Fees Are Funds Charging?

When investing in actively traded mutual funds, there are many fees to be aware of that could ultimately minimize your returns. Don’t overlook the importance of minimizing how much you’re paying to invest. Fees and account charges can really take a huge bit out of your money’s growth potential over time. Here are four common types of fees you should be aware of:

1) Expense Ratios – These are often the most visible fees within your investments. Expressed as a ratio (such as 0.90), this number represents a percentage fee, which covers the costs associated with running the mutual fund. These fees cover salaries of the fund’s employees, and also other costs of operation such as computers, the building lease, and office supplies.

2) 12B1 Fees – Not every mutual fund charges 12B1 fees, but many do, which can cost another 0.25% of your investment. These fees cover marketing expenses such as online ads, magazine ads, and television commercials.

3) Trading Costs – As the managers make trades on your behalf, costs are naturally incurred (just as you would incur a cost for making a trade yourself). These often account for another 0.2% that is charged to your account.

4) Sales Commissions – If you choose to have a broker invest money on your behalf, then you’ll likely be charged a fee for their services as well. Also, don’t forget that your broker may be monetarily incentivized to select certain funds over others. They may be tempted to select funds that pay them more, rather than funds that could perform the best for you. If this happens, not only are you paying a fee for their services, but your broker might also be costing you money by choosing an underperforming fund.

Earn Great Market Returns While Also Avoiding High Fees

To avoid the negative-sum game of actively managed funds, you might consider investing in ETFs that will perform along with the market for a very low fee such as SPY, which tracks the S&P 500 index or VTI, the Vanguard Total Stock Market ETF.

Open A Low Cost Investment Account And Save On Fees – Instead of opening a brokerage account with a platform like E*Trade, I recommend opening a free account with Motif Investing because their commissions are so much cheaper and they don’t charge any monthly fees.

If you’re an active investor, you can assemble your own personalized basket of up to 30 stocks or ETFs for just one commission of $9.95. If you were to buy that many positions using an account like E*Trade, you’d have to pay about $230 more! They make it easy to invest in your own ideas as well as themed motifs (baskets of stocks and ETFs) assembled by their teams as well as hundreds created the community.

Motif also offers passive investing products known as horizon motifs that are designed to match your personal risk tolerance (low, medium, or high) along with your investment time horizon (1 year, 5 years, or 15 years). There’s no need for you to pay a financial advisor expensive management fees every month when you can purchase ready-made products like the ones Motif Investing offers for super cheap and zero management fees.

Start Using Free Financial Tools To Grow Your Wealth – I highly recommend opening a free account with Personal Capital to help track all of your money in one safe and secure place in the cloud. If you want to learn more about how their service works, this Personal Capital review is really thorough and goes in depth.

Get A Free Personalized Investment Plan – Wealthfront is an excellent choice for personal wealth management for those who want the lowest fees and can’t be bothered with actively managing their money themselves. In the long run, it is very hard to outperform any index, therefore, the key is to pay the lowest fees possible while being invested in the market.

It’s free to open an account and get a personalized investment plan. Wealthfront charges $0 in fees for the first $10,000 you invest with them, only 0.25% for any money over $10,000, and only have a $500 minimum to get started. You can also sign up for a free personalized investment plan and see how you can put your money to work.

Invest your idle money cheaply, instead of letting it lose purchasing power due to inflation!

Untemplaters, do you prefer active or passive investing or perhaps a bit of both? Have you been sitting on your cash or have you been regularly investing it into the markets? Which do you think is better for your money – active investing or passive investing?